13th May 2024

For most of us, thinking about and planning for the end of life or what to do if you become incapacitated can carry a lot of different emotions. Even though it is not something that people want to think about, it is extremely important to have all your affairs in order before you pass or before you become incapacitated, so you can lay out your exact wishes and so your family and loved ones can carry them out for you with as little disruptions as possible.

WHAT IS ESTATE PLANNING?

It is the process of making known how you want your estate handled when you can no longer handle your own affairs during your lifetime, and after you pass away. It is not just for the wealthy. Estate Plans should include directions regarding your care, and management and distribution of all your property, assets, and belongings. Many different documents can be a part of an estate plan, including the following:

- Will

- Trusts (revocable and irrevocable)

- Financial Durable Power of Attorney

- Durable Power of Attorney for Care of Minor or Incapacitated Person

- Patient Advocate Designation

- Authorization to Disclose Medical Information

- Designation of Funeral Representative

It is important to regularly review your estate plan, either every two or three years or after any life-changing event. Depending on circumstances, your beneficiaries could change over time so keeping them as current as possible is recommended. Every document in your estate plan should be up to date so that when it is time to be used, it is straightforward for the individuals administering the estate.

Here are some things that you should do to help get your affairs in order.

CHOOSE SOMEONE TO HANDLE FINANCIAL MATTERS AND SOMEONE TO HANDLE MEDICAL AND CARE DECISIONS

These persons should be someone you trust completely because they are the ones who will be arranging for your care during periods of incapacity and administering your estate after you pass. You want someone you know will carry out your wishes exactly how you want them to be. You will want to select someone who is knowledgeable, organized, skilled at communicating, and mentally fit to take on the role. Oftentimes, the term fiduciary describes the individual in this role. A fiduciary is an individual or organization responsible for managing money, property, and assets for another individual. They have an ethical and legal duty to act in the best interest of another person, not their own.

TAKE INVENTORY OF YOUR ASSETS

This could feel overwhelming, but it is beneficial to make a list of all your assets and clarify who owns them (if they are just in your name or if they are jointly owned) and who you would like to receive them after you pass. Examples of this would be:

- Your home and any other real property

- Bank Accounts

- Retirement Accounts

- Life Insurance

- Stocks and Bonds

- Brokerage Accounts

- Vehicles

- Household Items

- Clothing & Jewelry

It is a huge weight to place on family and loved ones to take care of your home after you pass away so it would be a smart idea to start to go through all your belongings and condense as much as you can while you are still able. You should also simplify your finances if you can. If you have several 401(k) accounts from different jobs, or several bank accounts, it might be a good idea to consolidate these. By consolidating them, you can lower costs and make it easier for you, the Personal Representative or Trustee, and your beneficiaries to manage.

You should also be sure to make a list of monies you receive periodically. These would include:

WHERE YOU KEEP YOUR IMPORTANT DOCUMENTS

The ones caring for you and administering your estate or trust must know where to find all your important documents. It would be a good idea to keep most, if not all, of these documents and pieces of information in one location such as a safe deposit box or a fireproof safe. Some examples of these important documents are as follows:

- Wills, trusts, other estate planning documents

- Deeds, mortgages, and land contracts

- Titles to things like vehicles, boats, etc.

- Stock certificates

- Bank account information-bank name and location, account numbers, lock boxes, etc.

- Copies of tax returns

- Birth certificates, marriage certificates, and passports

- Military service records

- Insurance policies

DIGITAL ASSETS

Many people pay bills online, have shopping accounts, cloud storage, and manage their bank or investments online. Be sure that login and password information for each of these is saved in a specific location, preferably the same location as your other important documents.

You should also provide social media account information which should include the platform you have an account with (Facebook, Instagram, LinkedIn, Twitter, etc.), the login and password information, and instructions on what to do with the account after you pass or become incapacitated. If you own a website or have a blog, be sure to include how these accounts are accessed and what to do with these accounts after you pass or become incapacitated.

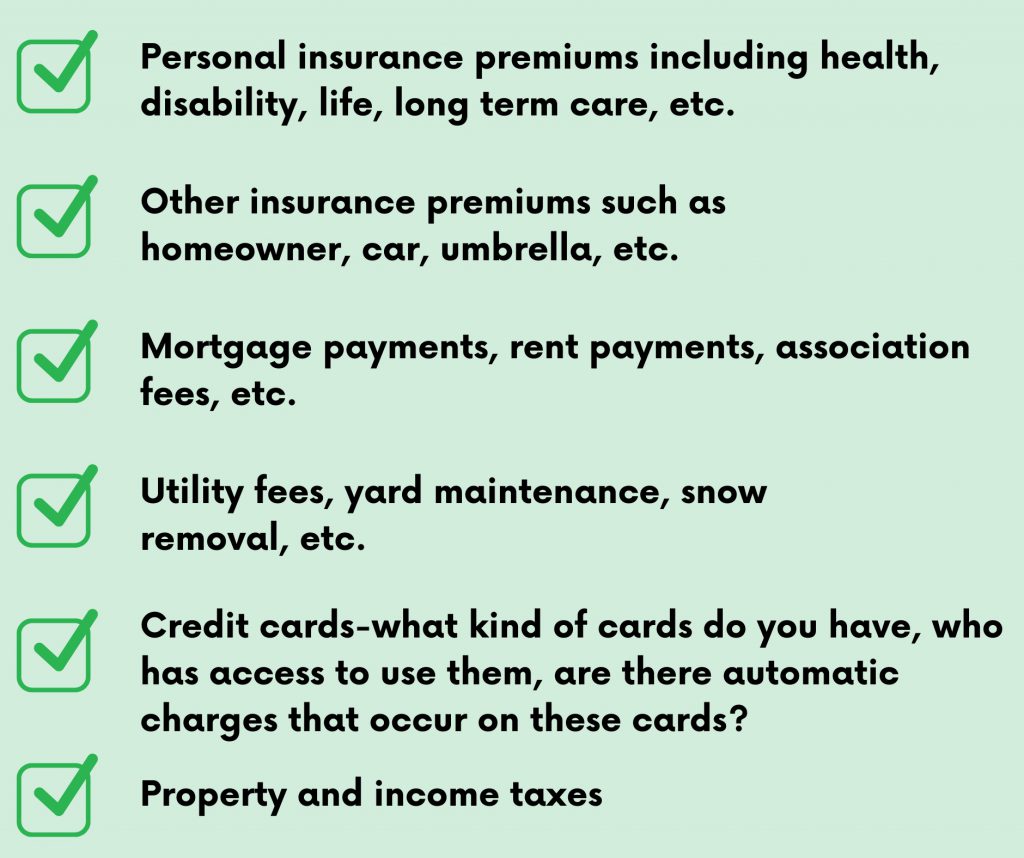

WHAT BILLS YOU PAY

If you become incapacitated, it is important that someone knows what bills you have, when they are due, and how you pay them. Some examples of the bills would be:

A LIST OF YOUR KEY CONTACTS

You should have a list of all your key contacts including their names, phone numbers, and addresses. The types of contacts you should document are:

- Brokers

- Financial Advisors

- Accountants

- Lawyers

- Doctors

- Insurance Agents

- Family Members

- Friends

- Clergy

END OF LIFE CARE

You should declare somewhere in your estate plan the care you wish to receive at end of life. First, do you have long term care insurance? You should educate yourself on what is included in that insurance plan. You should decide whether you would like to stay in your own home or if you would like to be in a facility. Also, you should make known your wishes when it comes to the use or withdrawal of life support measures as well as organ donation.

FUNERAL AND BURIAL/CREMATION

Since there are a lot of decisions involved in funeral and burial planning, it would be a wise idea to make these decisions and wishes before you pass away and leave these instructions for your loved ones. One of the first things you should do is name a Funeral Representative. This person will be the individual who will carry out your funeral wishes. You should also decide the following and make sure to discuss this with the appropriate individuals:

- If you want to be buried or cremated

- If you decide on cremation, you need to specify where you would like your ashes to be:

- Given to a specific individual

- Scattered somewhere specific

- Specify what types of religious or cultural traditions you would like during the funeral service, visitation, or memorial service

- Determine who you would like to be involved in the service

- Which funeral home you prefer

- Where you would like to be buried

- What you would like your headstone to look like

- Make the payment arrangements

You should make copies of all this information and keep the original documents in a fireproof safe or a safety deposit box. It is also important that you are open and communicative with those that will be administering your estate after your death. This does not have to be a grim conversation, but one that will provide the information necessary for your end-of-life care and administering your estate in the way you would like it to be.

Getting all your affairs in order will give you a sense of peace, knowing that everything is organized and easy to find and laid out exactly how you wish. Having an estate planning attorney walk you through this entire process will help limit the overwhelming feelings and make sure you do not miss any important information needed for your estate plan.

Written by Katherine B. Albrecht

State of Michigan Document-Inventory of Decedent Estate

Related Articles