19th May 2023

In the event that you die without a will in Michigan, your assets will be distributed to your relatives under Michigan Intestate Succession. This set of laws serves as a default will that instructs how and to whom your assets are distributed.

It is important to have all of your estate planning affairs in order before you pass away so you are able to put down your wishes for your assets and belongings. If distribution of your assets is left up to the probate court, the relatives that you would not want to benefit may end up with some of your assets. Also if you want someone who is not family to receive part of your estate, that would not happen through intestate succession because only family members receive your assets.

In addition to having a will, there are a few other ways to exempt assets from intestate succession laws. Intestate laws, and provisions in wills, do not apply to the following:

- Any assets that are titled in a living trust prior to your death

- Life insurance policies for which there is a living named beneficiary

- Jointly owned property with a surviving joint owner

- Retirement accounts for which there is a living named beneficiary

- Transfer-on-death (TOD) or pay-on-death (POD) designations on financial assets

The probate court will select a personal representative to administer your estate if you have not designated one in a will. It is important to name someone you trust in this position because it requires the person to settle and distribute your estate according to Michigan law. (Section 700.3703) The personal representative is responsible for using your estate assets to pay your funeral and burial or cremation expenses, your debts and taxes, and the expenses of administering your estate. The personal representative must also provide all the proper notices to the court, creditors, family members, etc., and close the estate when administration is complete.

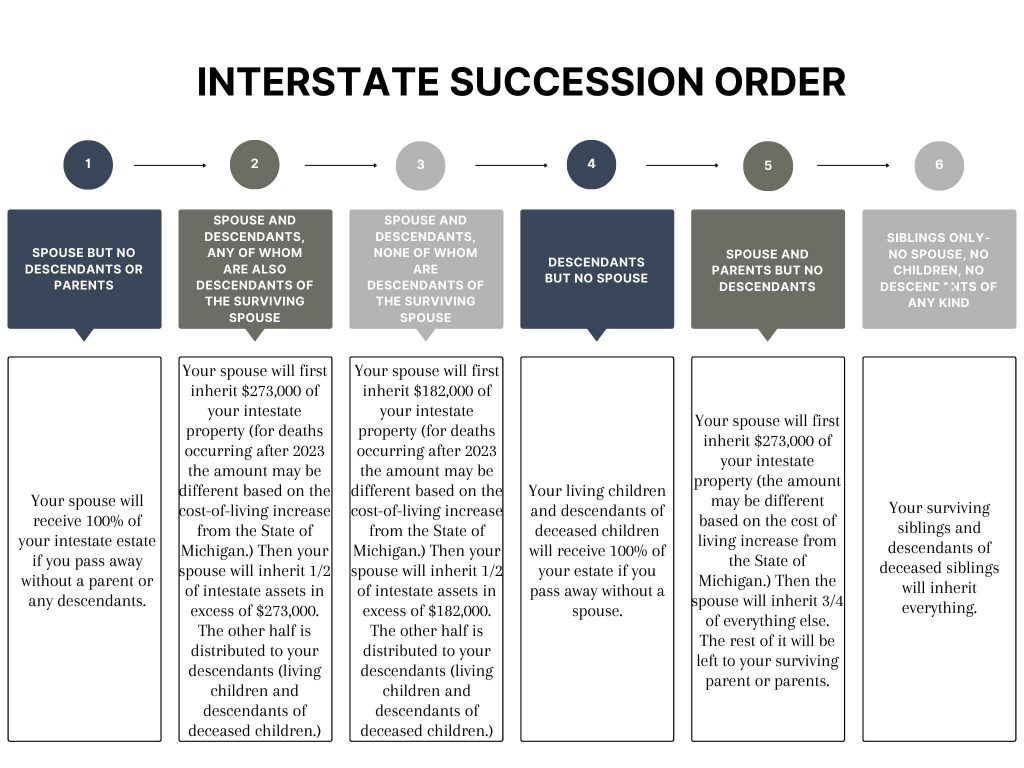

There is a certain order to which assets are divided through intestate succession. Who gets what depends on if you have a living spouse, living children or grandchildren, or living parents when you die. Here are different scenarios showing how your assets would be distributed after your death if you do not have a will in Michigan.

If you die and have minor children, if the children’s other parent is not living, the court will appoint a guardian for your other children. If you do not have a will that names a guardian, the court may appoint someone you would not want to raise your children.

In the event that you do not have a single living family member, i.e., no living spouse, descendants, parents, siblings, grandparents or descendants of grandparents, your assets will go to the State of Michigan. This is not very common because intestate laws are designed for your assets to be passed to family, as distant as they might be.

Dying without a will can create problems and place a huge burden on individuals in your family. The probate process in Michigan for intestate succession can take a long time, cost a lot of money in legal fees, and be incredibly stressful and complicated. Having the proper estate planning documents prepared by an experienced attorney, before your death, is important. This protects you, your loved ones, and your assets.

Written by Katherine B. Albrecht

Related Articles