3rd Oct 2023

Estimated reading time: 4 minutes

One of the most important decisions when it comes to creating a Trust is who to name as the Trustee. This job should not be taken lightly. Trustees are responsible for safeguarding your assets for you and your beneficiaries. Trustees are fiduciaries which means that they are legally responsible for handling money and property in the best interest of another individual, not their own. They have a legal duty to put the needs of the trust above their own.

The State of Michigan requires that a Trustee must be 18 years old. They must also be of a sound mind. While those requirements seem simple, choosing a Trustee is an extremely important decision. They must be someone you can trust completely, but it would also be wise to choose someone who is skilled in organization and communication and has some knowledge of financial matters. The individual must also have the time to devote to taking care of your trust. It can be an incredibly involved process. There may be some instances where the Trustee will encounter time-sensitive issues, so they will need to be available to handle those. You should choose someone who you trust to make good judgments and who has good common sense. This individual will be responsible for taking care of your estate exactly how you want it to be taken care of.

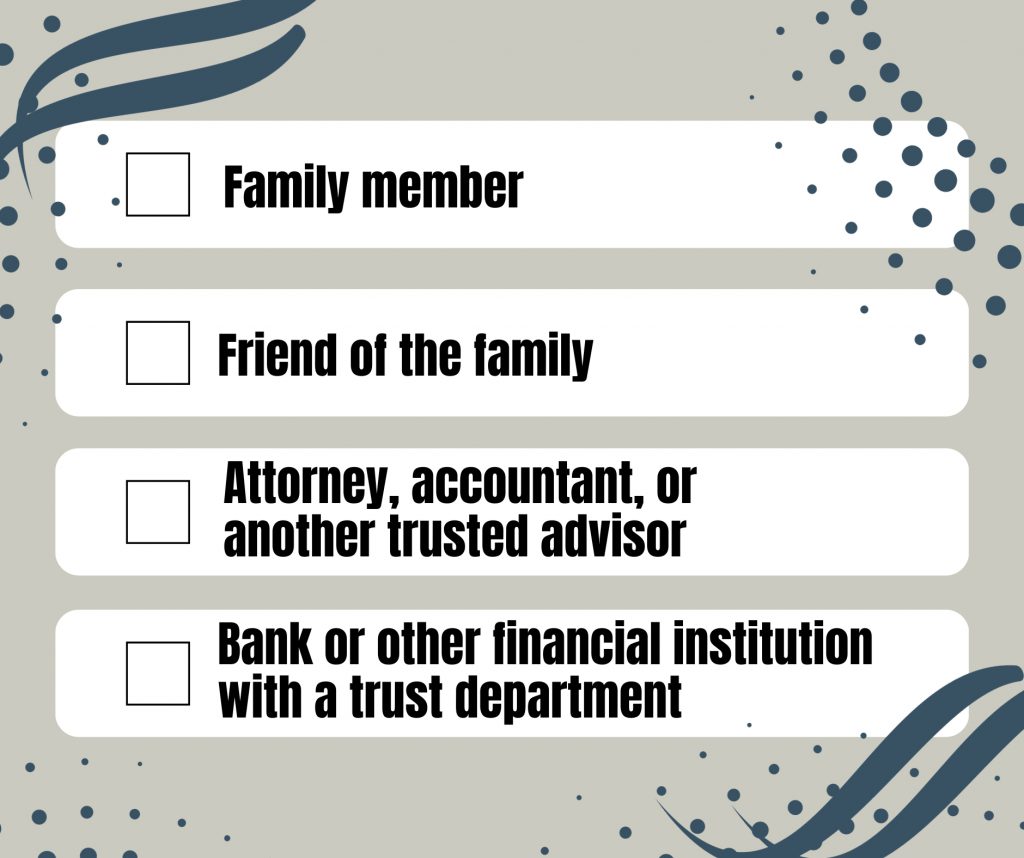

Trust estates vary in size. One trust can be rather simple, where a family member might be a desirable choice to name as Trustee, but others can be complex, which can also include operating or liquidating a business. The complexity of your trust estate should be considered when choosing a Trustee. There will more than likely be pros and cons to every type of trustee option. When choosing a Trustee, consider the following options for the position:

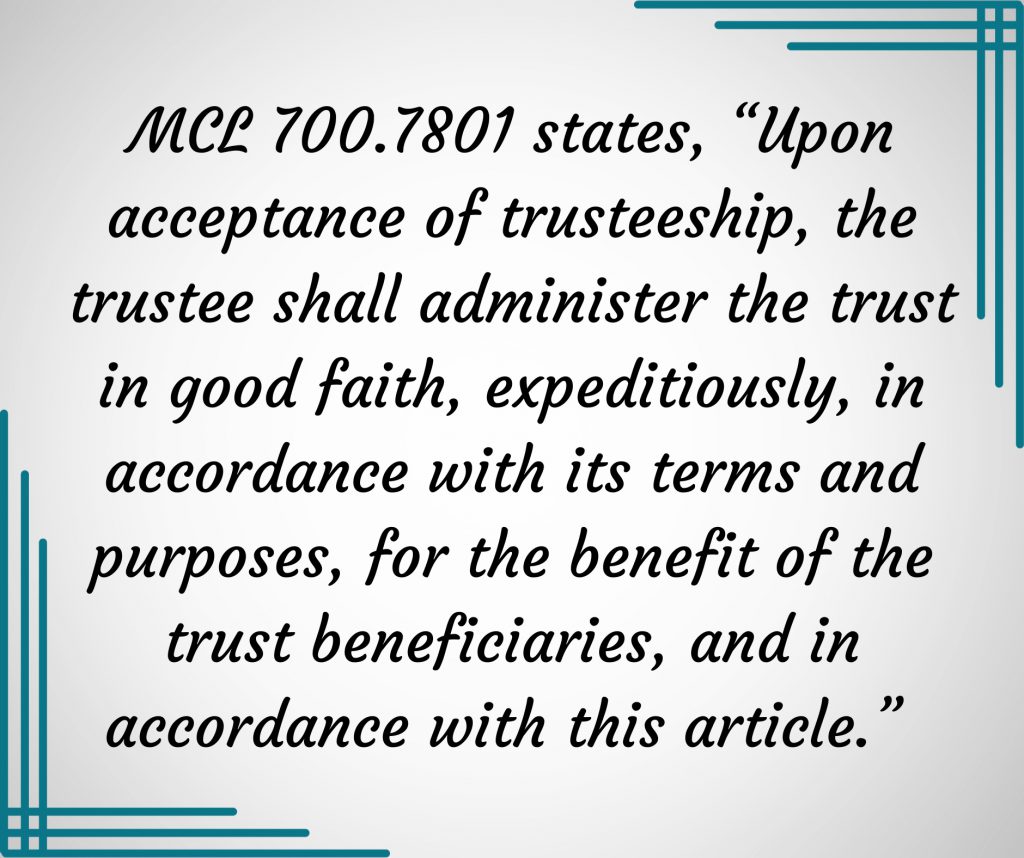

There are many responsibilities that come with the role of Trustee. In April 2010, the Michigan Trust Code went into effect. This is a set of laws that puts forth requirements for Michigan Trustees. The position of Trustee requires a significant amount of work. The main responsibility is to administer the trust. This means the Trustee must:

- Manage and distribute the assets and funds to beneficiaries in the manner called for in the Trust Agreement.

- Keep adequate records of the administration of the trust and create an annual report of all assets held in the trust estate, income received, and distributions made.

- Pay any bills that are due.

- Pay off debts.

- Resolve any claims or lawsuits that may arise.

- Notify creditors.

- Value the trust assets, including obtaining appraisals of personal items and real estate.

- Sell trust assets if necessary.

- Pay Federal and State taxes, including property taxes and income tax.

The Trustee should keep a detailed report of all the jobs they have performed as well as a time log for every one of those jobs. This will help determine the appropriate compensation for the Trustee for the work done in administering the trust.

As you can see, being named a Trustee comes with many important responsibilities. It would be wise to seek legal counsel to walk you through the process to ensure you are doing everything according to Michigan law and in the best interest of the trust if you agree to act as a Trustee.

Related Articles