1st Oct 2024

Estate Planning can be a complicated process especially since there is a lot of terminology that can be confusing. Understanding estate planning terminology can help make the estate planning process less overwhelming. Here we will break down a few terms to give you a better understanding of estate planning and what you need to protect you, your future, and your loved ones.

Will

A Will is a legal document that lays out your wishes when it comes to distributing your assets after you pass away. Its provisions take effect only after the Will is accepted by the probate court after your death. The Will disposes of assets titled in your sole name at your death. It also names guardians for your children.

Executor or Personal Representative

An Executor (also referred to as Personal Representative) is an individual or an organization you appointed in a Will to administer your estate after you die. The Executor’s primary role is to carry out the wishes expressed in your Will.

Codicil

This is a document that amends part of your Will with a change or addition. They typically are used when just part of the Will needs changing. This saves time and money since you are not changing the entire document.

Trust

A Trust is a legal arrangement by which assets are held for someone’s benefit. The person who creates the Trust is called the Grantor, Settlor, or Trustor. The person who holds legal title to the trust assets and carries out the terms of the legal arrangement is the Trustee. A person or entity for whose benefit the trust assets are held is called a Beneficiary. There are several different types of trusts. With your estate planning attorney, you can decide which is best for you based on the size of your estate, your goals and needs, and your wishes for your beneficiaries.

Grantor

The Grantor is the creator of the trust and the one that funds the trust. The Grantor could also be called the Trustor or Settlor.

Beneficiary

A beneficiary is a person, or an organization, that receives assets or property from your estate or trust. You should name beneficiaries, and backup beneficiaries, in case the initial beneficiaries die before you pass away. Beneficiaries are named in Wills, Trusts, Retirement Accounts, IRA’s, among others.

Trustee

Trustees are responsible for safeguarding your assets for you and your beneficiaries. Trustees are fiduciaries which means they are legally responsible for handling money and property in the best interest of another individual, not their own. They have a legal duty to put the needs of the trust above their own. The main responsibility of the Trustee is to administer the trust. A Trustee must be 18 years old, of sound mind, someone you can trust completely, who is skilled in organization and communication, has knowledge of financial matters, and has the time to devote to taking care of your trust since it can be an incredibly involved process.

Fiduciary

A Fiduciary is an individual or organization responsible for managing money, property, and assets for another. A Fiduciary has an ethical and legal duty to act in the best interest of another person, not their own. Under Michigan law, a Fiduciary includes a personal representative, funeral representative, guardian, conservator, and trustee.

Revocable Trust

A Revocable Trust is one that a Grantor creates during their lifetime. The Grantor is often the initial Trustee of the trust as well. It can be modified or revoked easily by the Grantor, as long as the Grantor is living and competent. Revocable Trusts often contain provisions specifying what is to happen to the trust assets after the Grantor’s death. Upon the Grantor’s death, the Revocable Trust becomes irrevocable because the Grantor was the only one with the right to amend or revoke the trust.

Irrevocable Trust

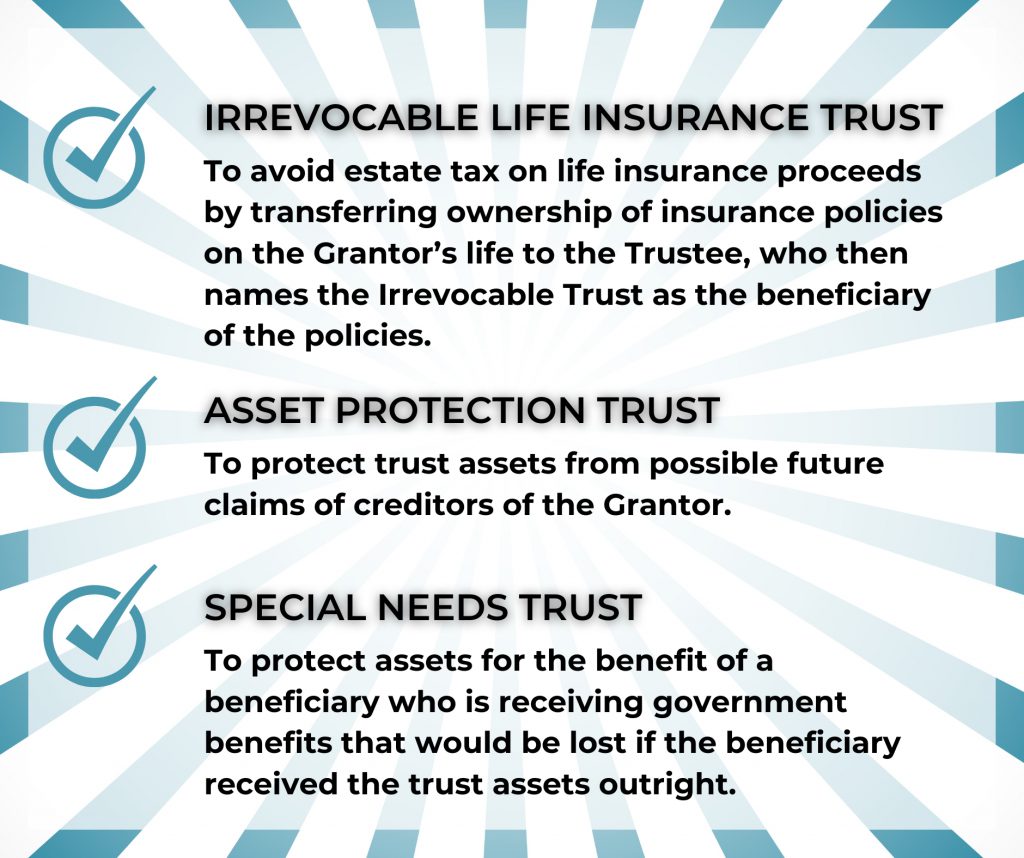

An Irrevocable Trust, as the name indicates, is one that cannot be revoked or amended. The Grantor generally is not the trustee. Because the Irrevocable Trust cannot be revoked or amended, when the Grantor transfers assets to an Irrevocable Trust he loses the ability to continue to use and control those assets. Therefore, Irrevocable Trusts are only used for certain purposes, most commonly:

Durable Power of Attorney

It is a legal document that designates someone as your agent to make certain decisions for you in particular situations. You may name someone as your agent to handle financial matters on your behalf, and your agent may exercise those powers whether or not you are competent to handle those matters for yourself. It is an important part of a comprehensive estate plan and the person you choose must be someone you completely trust. You may also name someone to make medical decisions on your behalf. This person is known as a Patient Advocate and is discussed below.

Probate

This is the legal court process of transferring assets titled in your sole name to beneficiaries following your death. The probate process first validates the will if you had one at your death, governs the payment of any debts you had at your death, provides for payment of expenses of administering your estate, and finally it will distribute assets and property to the beneficiaries according to your will, or if you do not have a will, according to state law.

This process can be very costly, and time-consuming, depending on the degree of court involvement. By properly setting up your estate plan, the probate process can be smoother and, in some cases, may be avoided altogether.

Pay on Death (POD)/Transfer on Death (TOD)

Pay on Death and Transfer on Death accounts are accounts that automatically pass to a named beneficiary after you die. This is an uncomplicated way to make sure particular people are entitled to an account you want them to have. When you pass away these accounts are triggered to immediately transfer assets and are not subject to provisions in a Will or Trust.

Patient Advocate Designation

A Patient Advocate Designation is a legal document that gives someone else the authority to make medical care and custody decisions for you if two physicians or a physician and a psychologist determine that you cannot make those decisions on your own. The decisions may include a choice to withhold or withdraw treatment. If you do not have a Patient Advocate Designation, but at some point in your life you do need one, then the probate court will appoint a guardian to make these medical care and custody decisions for you. It would be advisable to create a Patient Advocate Designation so you can choose exactly who you would like to make care choices for you.

Intestate Succession

It is a set of laws directing how and to whom your assets are distributed if you die without a will in Michigan. There is a certain order to which assets are divided through intestate succession. Who gets what depends on if you have a living spouse, living children or grandchildren, or living parents or siblings or nieces and nephews when you die.

Written by Katherine Albrecht

Related Articles